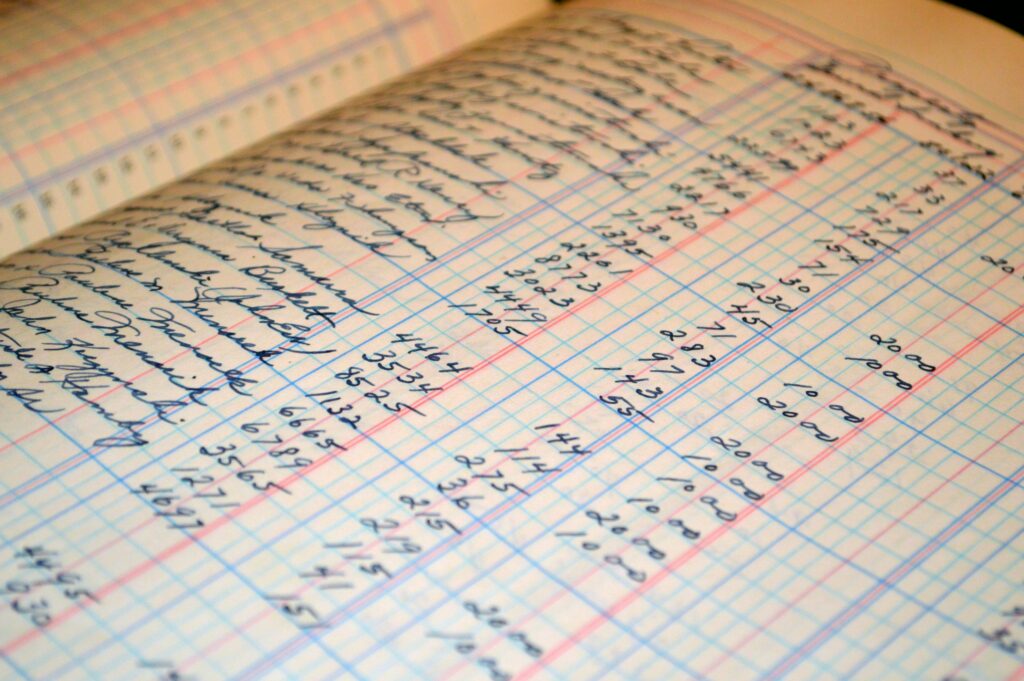

In the dynamic world of business, where innovation and strategy often take center stage, there’s a foundational element that deserves equal attention: bookkeeping. While it might not be the most glamorous aspect of running a business, bookkeeping is the bedrock upon which a strong, sustainable enterprise is built. After all, you wouldn’t build a house without putting up the foundation first.

The Role of Bookkeeping in Business Success

1. Financial Clarity and Control

At its core, bookkeeping is about maintaining accurate records of all financial transactions. This includes tracking income, expenses, assets, and liabilities. Without meticulous records, you’re navigating your business’s financial landscape blindfolded. Accurate bookkeeping provides clear visibility into where your money is coming from and where it’s going, allowing you to make informed decisions about budgeting, investing, and managing cash flow.

2. Facilitates Financial Planning and Strategy

A solid bookkeeping system doesn’t just record past transactions; it also helps in forecasting future financial performance. With accurate records, you can analyze trends, identify patterns, and make data-driven decisions. This is essential for setting realistic financial goals, planning budgets, and strategizing growth. For instance, understanding seasonal fluctuations in your revenue can help you plan for lean periods and allocate resources more effectively. Without accurate records, you cannot rely on the numbers for solid financial planning.

3. Streamlines Tax Preparation and Compliance

Tax season can be a nightmare if your books are not in order. Proper bookkeeping ensures that all your financial data is organized and readily available, making tax preparation smoother and less stressful. It also helps in staying compliant with tax regulations and avoiding penalties. By keeping up-to-date records, you can ensure that all deductible expenses are accounted for and that you’re prepared for any audits or reviews.

4. Enhances Financial Decision-Making

In the absence of accurate financial records, making sound business decisions becomes challenging. Bookkeeping provides the necessary data to evaluate the financial health of your business. For example, if you’re considering a major investment or loan, having precise records can help you assess whether your business can handle the financial commitment and what impact it might have on your overall health.

5. Builds Trust with Stakeholders

Transparency is key in building trust with investors, lenders, and other stakeholders. Accurate and up-to-date bookkeeping provides a clear picture of your business’s financial status, which is crucial when seeking investment or credit. It demonstrates that you’re on top of your financial affairs and can be relied upon to manage funds responsibly.

6. Supports Operational Efficiency

Efficient bookkeeping doesn’t just aid in financial matters; it can also enhance overall operational efficiency. For instance, by tracking expenses and revenues meticulously, you can identify areas where costs can be cut or where additional investments are needed. This operational insight helps streamline processes, optimize resource allocation, and improve overall business performance.

7. Prevents Financial Fraud and Errors

Regular and accurate bookkeeping helps in identifying discrepancies and potential fraudulent activities early on. By keeping a close eye on every transaction, you can spot errors or unusual patterns that might indicate fraud or financial mismanagement. This proactive approach can save your business from significant financial losses and legal troubles.

Implementing Effective Bookkeeping Practices

To leverage the full benefits of bookkeeping, consider the following best practices:

- Use Reliable Software: Modern bookkeeping software can automate many tasks, reducing human error and improving efficiency.

- Regular Updates: Consistent updating of financial records ensures that your data is current and accurate.

- Hire Professionals: If bookkeeping seems overwhelming, hiring a professional accountant or bookkeeper can provide expertise and peace of mind.

- Regular Reviews: Regularly review and reconcile your records to catch and correct any discrepancies.

Conclusion

Bookkeeping might not always be the star of the show, but it plays a critical role in the success of any business. It offers financial clarity, supports strategic planning, simplifies tax preparation, and fosters trust with stakeholders. By recognizing the importance of bookkeeping and implementing best practices, you lay a solid foundation for your business to thrive.

In the end, while you focus on innovation and growth, remember that keeping your books in order is just as important as any other aspect of your business strategy. After all, a well-kept ledger is the silent partner in your journey toward long-term success.

If you need help getting your books up to snuff or don’t want to deal with the hassle of doing it yourself as a business owner, High Impact CPA and our team of experts can help. Reach out here to set up a free call with a Partner: